Here is a comprehensive article on Crypto, Raydium (RAY), Liquidation, and Gas:

Title:

“Navigating the Crypto Market Turbulence with Raydium (RAY) and Understanding Liquidity Protocols”

As the global cryptocurrency market continues to fluctuate rapidly in response to various factors such as regulatory changes, technological advancements, and social trends, investors are looking for reliable tools to navigate this volatile space. Two of these crucial components that have gained significant attention lately are Raydium (RAY) and Liquidity Protocols.

Radium (RAY)

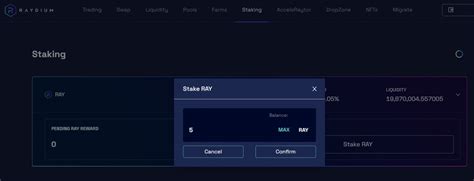

Raydium is a decentralized finance (DeFi) protocol designed specifically for traders. It runs on the Binance Smart Chain (BSC), allowing seamless interactions between users of different blockchain networks without the need for external intermediaries. This makes RAY an attractive option for those looking to trade and manage their digital assets across multiple exchanges.

One of the key features that made Raydium stand out is its commitment to security, ensuring that all user funds are stored in a hardware wallet and are not accessible through software. This approach has earned RAY a reputation as one of the most secure DeFi platforms available, making it an attractive option for both institutional investors and high net worth individuals.

Liquidation Protocols

In addition to Raydium, there is another key player facilitating liquidity in the cryptocurrency market – Liquidation Protocols. These protocols allow users to sell their digital assets at a reduced price by connecting with other traders who are willing to buy them at their current prices. The main difference between these platforms and Raydium lies in their approach.

Liquidation protocols rely on external exchanges or market makers, who act as an intermediary between buyers and sellers. This model provides liquidity to the market, but often comes with higher fees compared to decentralized options like Raydium. However, it also provides greater exposure to the broader market, allowing users to tap into more liquidity than they would otherwise be able to access directly through their own exchanges.

Understanding Gas

Gas is another crucial aspect of cryptocurrency trading that can have a significant impact on trading and market volatility. It refers to the time (in seconds) it takes for the network to validate a transaction, including verifying the sender and recipient addresses, transaction data, and other details. When gas prices are high, it indicates congestion on the blockchain network, leading to slower transaction times and increased fees.

Understanding how to navigate these conditions is vital for traders looking to maximize their gains or minimize losses in volatile market environments. By choosing the right liquidity protocol, such as Raydium, and understanding gas rates, investors can better manage the risks associated with trading cryptocurrencies.

Conclusion

In conclusion, Raydium (RAY) has emerged as a leading DeFi platform, offering unparalleled security and liquidity for traders. However, its impact extends beyond its own network, influencing market dynamics through external protocols such as Liquidation. While gas remains an essential component of cryptocurrency trading, understanding it is crucial for those navigating the complex world of digital assets.

As the crypto landscape continues to evolve, being informed about these key components will help investors make more informed decisions and capitalize on opportunities as they arise.

Leave a Reply