MARKING Psychology and its impact on Cardano (Ada)

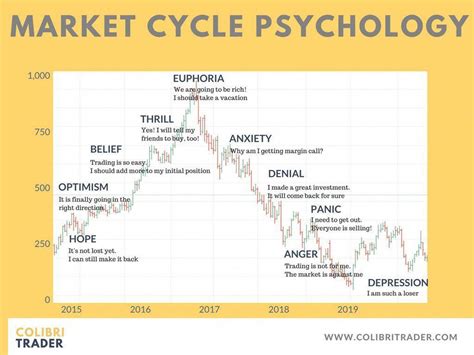

The world of cryptocurrencies has seen significant growth and volatility in recent years. One aspect that has attracted attention is market psychology, a study on how the emotions and attitudes of investors towards property influence its price movements. In this article we will examine the concept of market psychology and its impact on Cardano (Ada).

What is market psychology?

Rather, market psychology applies to the study of how individuals make decisions based on their emotional conditions and not exclusively on objective factors such as data and analysis. This includes understanding how their investment decisions influence emotions, the prejudice of investors and past experiences. In the context of cryptic, market psychology can be particularly important due to its high volatility and the involvement of individual investors and institutional actors.

The role of emotions in market psychology

Emotions play an important role in market psychology, as they can lead to the decisions of investors who buy or sell activities quickly. Fear, greed, excitement and anxiety are emotions that can influence the feeling of the market. For example::

* Fear: Investors can become more cautious and heavier investments due to the concerns for the safety of their funds.

* Pavidity:

On the other hand, investors can be more aggressive and long for a quick profit, leading to the refund of activities.

* Excitement: The excitement of new technologies or innovative ideas can create a sense of euphoria among investors, leading them to the purchase of activities at inflated prices.

Influenza on Cardano Prices (Ada) **

Cardano (Ada) is a cryptocurrency that has acquired considerable attention in recent years due to its scalability, safety and decentralized management of public affairs. As with any activity, market psychology can have a significant impact on its price movements.

For example::

* Increase in adoption: When more people are interested in Cardano, they can buy Ada at higher prices and increase the value of the activities.

* Fear of Missing (Fomo): The fear of losing potential profits can induce investors to hurry up to buy ada at high prices only to be disappointed when the price is falling.

However, market psychology can also have a negative impact on Cardano (Ada). For example::

* SUR -trading: Fear and greed can lead to an excessive transmission, because investors make impulsive decisions based on emotions than on the analysis of sound.

* Confirmation of distortions: Investors can selectively look for information that confirm their existing prejudice, which leads them to ignore or refuse contradictory evidence.

Profile of Cardano Mercato Psychology (Ada)

In order to better understand the impact of market psychology on Cardano (Ada), we must examine his psychology profile on the market. According to various studies and analysis, the psychology of the cardan market can be characterized as follows:

* Risk aversion: Many investors consider Cardano as a relatively safe activity that attracts their potential for long -term growth.

* Specular: The high volatility of the Kartodo prices can lead to some speculation investors on the moves of future prices that can create an environment that leads to market management and pump and payment patterns.

Conclusion

Market psychology plays an important role in Cardano (Ada) behavior. While emotions as fear, greed, excitement and anxiety can lead to investment decisions, they can have a negative effect on the values of activities when exaggerated. By understanding market psychology, investors and market participants can focus better on these complex markets and make more informed decisions.

Advice

Investors and market participants should be alleviated to relieve the risks associated with market psychology:

1.

Leave a Reply