Here is an article based on the target keywords:

**”The Art of Trading in a Volatile World: How to Stay Ahead with Litecoin and the Best Cryptocurrency Exchange”

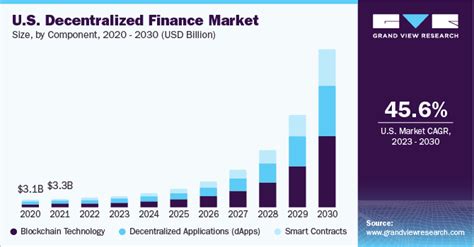

In today’s fast-paced and rapidly growing cryptocurrency market, trading psychology plays a crucial role in making informed decisions about buying and selling digital assets. While some investors are willing to take the risks involved in trading, others prefer safer options like traditional stocks or bonds.

One cryptocurrency that has been gaining significant attention recently is Litecoin (LTC). As the fourth largest cryptocurrency by market capitalization, LTC has been a popular choice among traders and investors alike. But what sets it apart from other cryptocurrencies? And how can you successfully trade Litecoin using the best cryptocurrency exchange?

What makes Litecoin special?

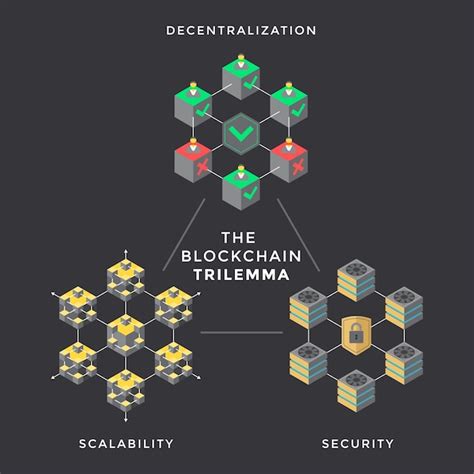

Litecoin is an open-source peer-to-peer cryptocurrency that was created in 2011 as a fork of the Bitcoin protocol. What sets LTC apart from other cryptocurrencies is its faster transaction processing times, lower fees, and greater scalability compared to Bitcoin.

According to CoinMarketCap, Litecoin has seen significant growth in recent months, fueled by the increasing adoption and use cases of the cryptocurrency. As the demand for LTC continues to grow, it is important to stay informed about market trends and trading strategies that can help you capitalize on this trend.

Trading Psychology with Litecoin

When trading Litecoin or any other cryptocurrency, it is very important to take a well-researched and informed approach. Here are some key aspects of trading psychology that can help you make better decisions:

- Risk Management: Trading involves risk, and it is important to manage your emotions and set stop-losses to limit potential losses.

- Diversification: Spread your investments across different cryptocurrencies to reduce market volatility.

- Fundamental Analysis: Understand the economics and technology behind each cryptocurrency to make informed decisions.

- Technical Analysis: Use technical indicators and charts to identify trends, patterns, and potential entry points.

Top Litecoin Cryptocurrency Exchanges

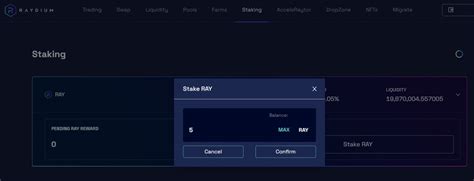

If you want to trade Litecoin easily, consider using a reputable cryptocurrency exchange such as Binance or Coinbase Pro. Both platforms offer a wide range of trading options, including margin trading, futures trading, and spot trading.

Here’s why we recommend Coinbase Pro:

- User-friendly interface: Coinbase Pro is an intuitive platform that makes it easy to navigate and trade.

- Comprehensive Listing

: The exchange lists over 4,000 cryptocurrencies, giving you access to a wide range of options.

- Strong Security

: Coinbase Pro uses advanced security measures to protect your assets, including two-factor authentication and multi-token wallets.

Ultimately, trading Litecoin requires careful analysis, risk management, and a good understanding of the cryptocurrency market. By taking a well-researched approach and using a reputable exchange like Coinbase Pro, you can increase your chances of success in this rapidly changing space.

Disclaimer: This article is for informational purposes only and should not be construed as investment advice. Always do your own research and consult a financial advisor before making any investment decisions.